Real-Time Request For Payment

How to Real-Time Request For Payment

In a world where speed and security define the future of payments, businesses and individuals are demanding solutions that go beyond traditional methods. Manual invoicing, ACH delays, and exposure of banking information are no longer acceptable in a real-time digital economy.

Real-Time Request for Payment (RfP), powered by both FedNow® and RTP® (Real-Time Payments), allows a Payee to send a structured, secure request for money to a Payer, who can instantly authorize and fulfill the transaction. Using the ISO 20022 standard for data messaging, the RfP process is intelligent, interoperable, and highly secure—supporting alias-based identifiers so that neither party ever needs to share sensitive financial details.

At TodayPayments.com, we provide a full suite of tools to help you send, receive, and reconcile RfP transactions instantly and privately.

What Is a Real-Time Request for Payment (RfP)?

A Request for Payment (RfP) is a structured digital request initiated by a Payee asking a Payer to authorize and send funds. It is delivered via secure channels using ISO 20022 messaging standards and processed in real time through FedNow® or RTP®.

Key features include:

- A clear request showing the purpose, amount, and payment deadline

- Instant approval by the Payer through their banking platform

- Immediate settlement of funds upon approval

- Full visibility into the status of the request and confirmation upon completion

This method reduces delays, improves cash flow, and adds transparency to payment interactions.

Alias-Based RfP for Privacy and Flexibility

To protect financial identities, both Payees

and Payers can use aliases or monikers instead of sharing bank

account details.

This includes:

- Using cell phone numbers or email addresses as secure transaction identifiers

- Routing payments using linked Merchant Identification Numbers (MIDs)

- Supporting multi-party billing while maintaining financial privacy

By replacing sensitive account numbers with alias-based routing, the transaction remains secure and efficient, without compromising user privacy.

Real-Time Rails: FedNow® and RTP® Integration

TodayPayments.com connects to both FedNow® and RTP® networks, which offer:

- 24/7/365 real-time payment settlement

- End-to-end transaction visibility with immediate confirmation

- Instant funds availability in the recipient’s bank account

- Support for static or dynamic payment requests, depending on business needs

These capabilities make real-time RfP ideal for enterprise billing, contractor payments, rent collection, and recurring invoices.

ISO 20022 Messaging Enhances Transaction Intelligence

The backbone of the RfP system is ISO 20022, which supports rich, structured messaging that allows:

- Inclusion of invoice numbers, payment details, and due dates

- Cross-platform compatibility across banks, credit unions, and fintech apps

- Compliance with international standards for secure payment communication

Whether you're managing hundreds of requests or just a few, ISO 20022 gives you control and traceability for every payment request.

Use Cases for Real-Time Request for Payment

Real-time RfP is used across industries and customer segments, including:

- B2B and B2C billing cycles

- Property management and rent collections

- Freelance, gig economy, and contractor payments

- Government and tax-related requests

- Utility, telecom, and subscription-based billing

This flexibility makes RfP a universal tool for collecting payments faster and more securely.

Hosted Payment Pages and RfP Response Portals

To streamline the payment experience, we offer:

- Custom Hosted Payment Pages branded for your business

- Clickable links embedded in emails or messages tied to each RfP

- Real-time notifications and automatic fund transfers upon Payer approval

This eliminates the need for PDFs, manual bank entry, or third-party platforms.

Real-Time Reconciliation and Alias Management

Every RfP sent through TodayPayments.com includes:

- Real-time reconciliation dashboards for finance teams

- Tracking by alias, MID, or invoice ID

- Multi-bank and multi-location support with QuickBooks® Online (QBO) integration

Your accounts are always up to date, and every payment is matched automatically.

Get Started with Real-Time Request for Payment Today

With

TodayPayments.com, you can:

✅ Send

real-time RfPs using alias-based security

✅ Set up

ISO 20022-compliant payment requests with full metadata

✅

Receive instant payments via FedNow® and RTP®

with zero delays

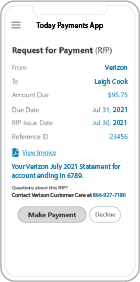

Real-Time Request for Payment (RfP) using digital invoices from payees/billers to payers for both B2B (Business-to-Business) and C2B (Consumer-to-Business) transactions is a significant innovation in the payments landscape, particularly leveraging the ISO 20022 standard. Here’s an overview of how this works and its benefits:

Real-Time Request for Payment (RfP)

- Definition:

- Request for Payment (RfP): A digital request sent by the payee/biller to the payer, asking for payment. This can be used in various scenarios, including B2B and C2B transactions.

- ISO 20022 Standard:

- ISO 20022: A global standard for financial messaging that enables rich data content and consistency across payment systems. It supports extensive data fields that can carry detailed remittance information, making it ideal for digital invoicing and payments.

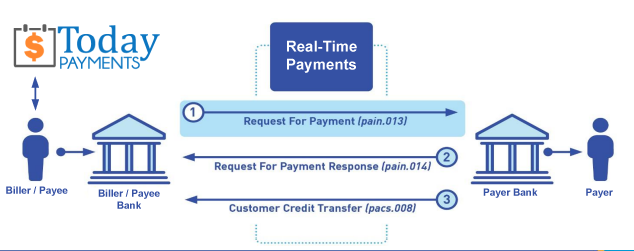

How RfP Works in B2B & C2B

- Payee/Biller Initiates RfP:

- The payee/biller creates a digital invoice and sends an RfP to the payer using the RTP or FedNow network.

- The RfP message includes details such as the invoice amount, due date, and remittance information in the ISO 20022 format.

- Payer Receives RfP:

- The payer receives the RfP through their banking or payment app.

- The payer can review the details of the request and choose to approve and initiate the payment.

- Instant Payment:

- Upon approval, the payment is processed instantly through the RTP or FedNow network.

- The payee receives the funds in real-time, and the transaction is settled immediately.

- Reconciliation and Confirmation:

- Both the payer and payee receive confirmation of the payment.

- The rich data provided by ISO 20022 ensures easy reconciliation and reduces errors.

Benefits of RfP for B2B & C2B

- Efficiency:

- Reduces the time between invoicing and payment.

- Streamlines the payment process, eliminating the need for paper checks or manual intervention.

- Cash Flow Management:

- Improves cash flow by enabling quicker payment receipt.

- Enhances predictability and planning for both payers and payees.

- Security:

- Enhances security by using standardized, encrypted messaging.

- Reduces the risk of fraud compared to traditional payment methods.

- Data-Rich Transactions:

- ISO 20022 provides comprehensive remittance information, making it easier to match payments with invoices.

- Supports detailed reporting and analytics.

- Customer Experience:

- Provides convenience for payers by offering a simple, efficient way to make payments.

- Enhances the overall payment experience with instant confirmation and transparency.

- Integration with Accounting

Systems:

- Can be integrated with systems like QuickBooks Online (QBO) to automate invoicing, payment tracking, and reconciliation.

- Ensures that financial records are updated in real-time, providing accurate and up-to-date information.

Example Workflow in QuickBooks Online (QBO)

- Invoice Generation:

- A business generates a digital invoice in QBO and sends it as an RfP via RTP or FedNow.

- RfP Sent:

- The RfP, formatted in ISO 20022, is sent to the payer’s bank or payment application.

- Payment Approval:

- The payer receives the RfP, reviews the details, and approves the payment.

- Instant Payment and

Confirmation:

- The payment is processed instantly, and both parties receive confirmation.

- QBO automatically updates the invoice status and reconciles the payment.

- Record Keeping:

- All payment details and remittance information are stored in QBO, ensuring comprehensive record-keeping.

By adopting Real-Time Request for Payment with ISO 20022, businesses can significantly enhance their payment processes, improve cash flow, and provide a better experience for their customers and partners.

Features & Benefits

FedNow instant payments has benefits for all parties involved in

Financial Transactions.

Benefits to your company include:

Money Transfer: Current limit of $1,000,000 ~ FedNow, $10,000,000 ~ RTP.

Money Transfer: Current limit of $1,000,000 ~ FedNow, $10,000,000 ~ RTP.

It's Fast: 24/7/365 access to funds anytime vs.

several days for paper checks or ACH transfers to process.

Request for Payments ( RfP ™): Mobile & Online Real-Time Bill Payments.

It's Final: All RTP and Instant Payments are Final & Irrevocable.

Software Integration: Integrate your Management

or Enterprise software with us.

Message Detail: Full 145 characters available

using ISO 20022 messaging XML format.

Online Down Payments: Don't use inconvenient

and expensive Wires & Cashier's Checks.

Online Real-Time Reporting: Configured

Dashboard with Virtual Terminal login.

Reduced calls / emails in the "Purchasing Chain": All

parties to a instant payment transaction receive immediately

text & email messaging.

The

FedNow and RTP Systems enables Participants to initiate credit transfers,

receive final and irrevocable settlement for credit transfers,

and make available to Receivers funds associated with such

credit transfers in real-time, twenty-four (24) hours a day,

seven (7) days a week, fifty-two (52) weeks a year. All instant payments are "Credit

Push" instead of "Debit Pull."

Creation Request for Payment Bank File

Call us, the .csv and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Create Multiple Templates. Payer/Customer Routing Transit and Deposit Account Number may be required to import with your bank. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Payer Routing Transit and Deposit Account Number is NOT required to import with your bank. We add your URI for each separate Payer transaction.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing